The realm of digital currencies is rapidly evolving, with new platforms constantly emerging and existing ones making their mark. Among these is Solana, a high-performance blockchain that has recently gained significant attention. However, as with any cryptocurrency, Solana’s journey is subject to market dynamics and trends. Let’s delve into our current Solana price prediction and what it might mean for potential investors.

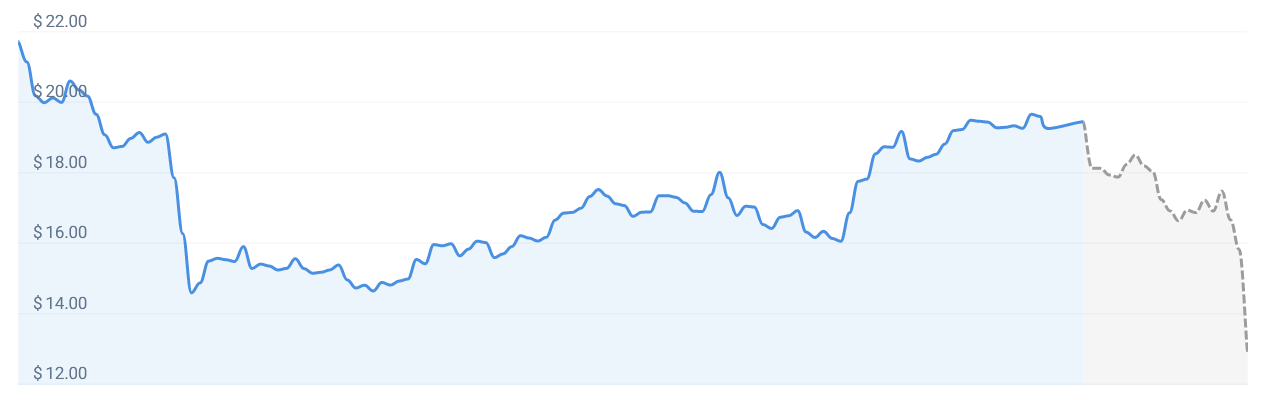

According to our recent analysis, Solana’s value is projected to decrease by approximately -32.89%, reaching an estimated price of $12.94 by July 10, 2023. These predictions, while not set in stone, are derived from meticulous analyses of various technical indicators and market trends. It’s important to remember that the inherently volatile nature of cryptocurrencies often results in drastic swings in price predictions.

As per our technical indicators, the current sentiment towards Solana is bearish. This implies that market participants are currently more inclined towards selling rather than buying. A bearish sentiment often indicates concerns or lack of confidence in the asset’s short-term performance, resulting from a range of factors such as broader market trends, regulatory news, or changes in the technology itself.

Simultaneously, the Fear & Greed Index for Solana stands at 61, firmly in the ‘Greed’ category. This interesting contrast between a bearish market sentiment and a high Fear & Greed Index underscores the complexities of the cryptocurrency market. A high Fear & Greed Index suggests that investors are driven by the potential of high returns, and are willing to buy despite inherent risks, possibly indicating a level of overconfidence that could precede a market correction.

Over the past month, Solana has recorded a decent performance, with 18 out of 30 days, or 60%, being ‘green days.’ A ‘green day’ signifies a day when the cryptocurrency’s price has increased from the previous close. Yet, it is critical to note that this positivity comes amidst a backdrop of 10.03% price volatility over the past 30 days. While high volatility is not unusual in the cryptocurrency market, it serves as a reminder of the risk and unpredictability that come with investing in such assets.

Given the confluence of these factors, our current Solana forecast suggests that this might not be the best time to invest in Solana. The anticipated decline in value and the bearish sentiment indicate potential pitfalls for new investments. However, it’s important to remember that the rapidly changing nature of the cryptocurrency market means such forecasts should be used as guidance, not as infallible predictions.

On the other hand, for those who believe in the long-term potential of Solana, this price drop could be seen as an opportunity. The projected decrease might provide a more attractive entry point for investors willing to weather the short-term storm for a potential long-term gain. History has shown us that after substantial drops, many cryptocurrencies have rebounded and achieved new highs.

In conclusion, while the current short-term forecast for Solana seems to lean towards a negative trend, it is essential to remember that the long-term outlook for most cryptocurrencies, including Solana, is often subject to rapid changes. As with all forms of investment, it is critical to conduct thorough research, stay updated on market news, and consider seeking advice from financial professionals. Making informed decisions, understanding the volatility of the market, and being prepared to adapt to changes is integral in the realm of cryptocurrency investment. The world of digital currencies is not a simple one, but for those who can navigate it well, it holds the potential for significant returns.